A Beginner Guide to Supply Chain Finance (SCF)

Published byUnderstanding Supply Chain Finance (SCF)

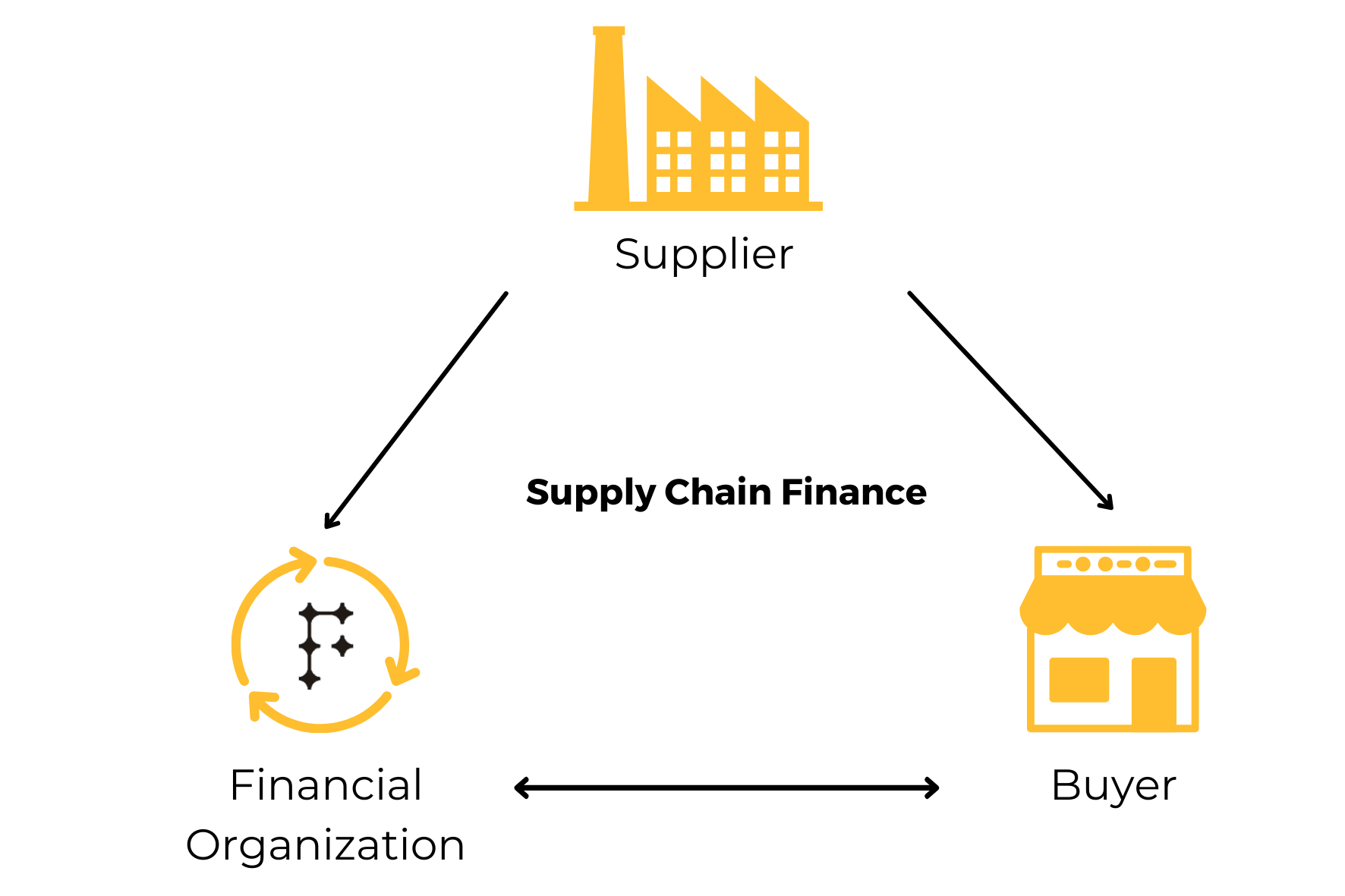

Supply chain finance, also known as supplier finance or reverse factoring is a financial technology solution aims to improve business efficiency for buyer and supplier linked in a sale transaction. Basically, the supply chain ecosystem consists of mainly the buyer, supplier and funder, or known as financial organization. Linking of these three parties, supply chain finance improves cash flow, reduces supply chain risk, and provides predictable return on investment for funders.

(Source: Fynance.io)

As capital is critical to every business, corporate payments are often seen as a persistent challenge during a trade. Here comes the supply chain finance where it provides a set of solutions that improve cash flow by allowing businesses to optimize their payment term while allowing suppliers to get paid early.

Basically, supply chain finance acts as a system to benefit both buyer and supplier. Note that the supply chain finance is neither loan nor financial debt. There is no lending on either side of buyer or supplier, which means there will be no impact to the balance sheet.

Success key factors for SCF program implementation

1. Define clearly your target and goals

Any corporate shall have clear idea on what is the purpose of setting the financing program- whether to extend the supplier payment term, remove financial risk, deploying company cash or a combination. This is to ensure the targets is accordance with the action taken.

2. Understand and analyze your opportunity

Any organization should be clear on their strength and analyze the micro and macro environment before starting the supply chain finance program. This also include detail spend and working capital analysis, as well as discounts where the market can bear with and desire time frame.

3. Involve the right stakeholders

Collaboration across various business functions is one of the core factor to determine the success of supply chain finance. For any Supply Chain Finance program to be successful, every department that is involved must be able to clearly recognize the benefits that the program will provide them.

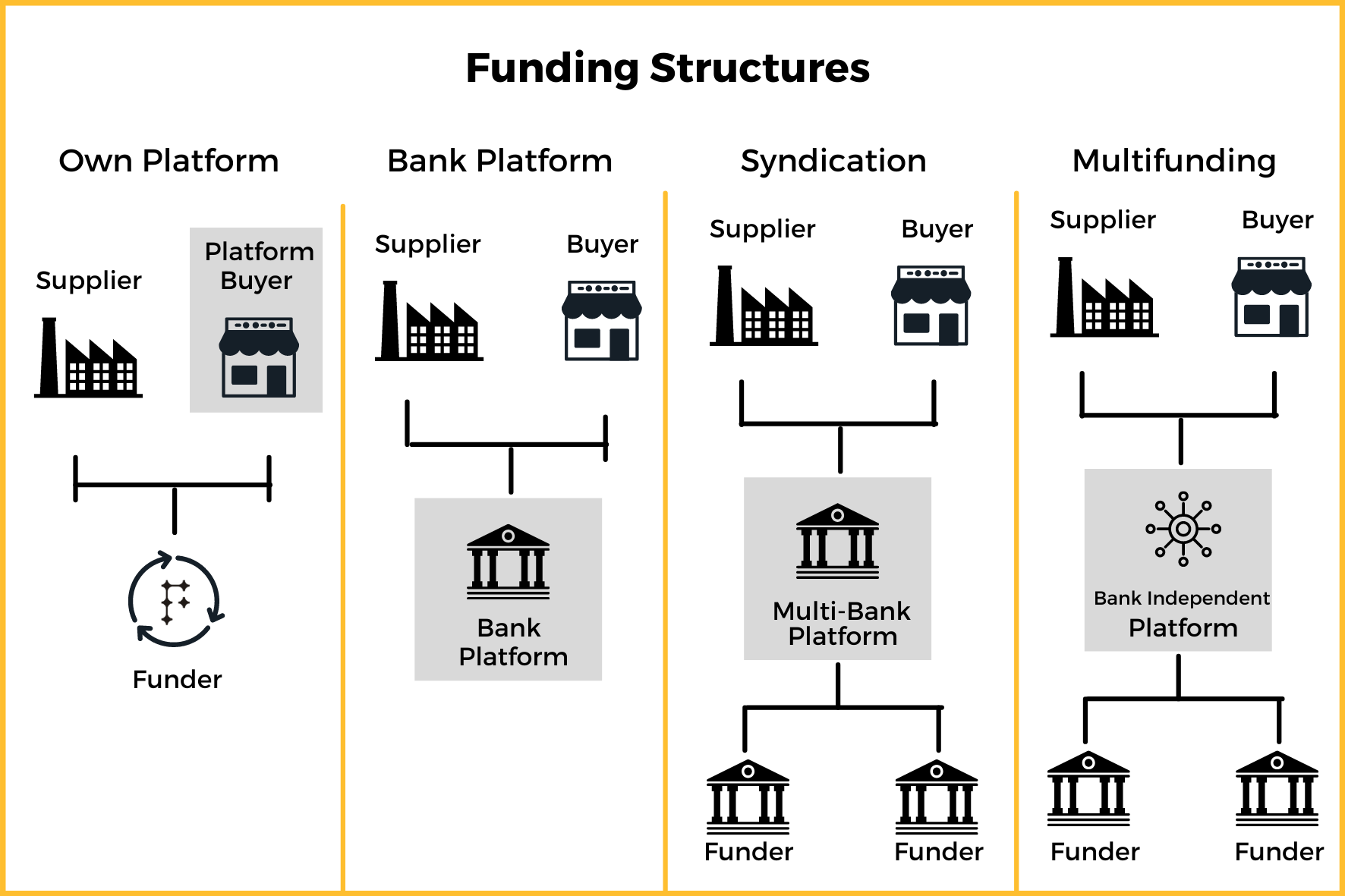

4. Program conceptualization and implementation

Selecting the right funding structure to kick start of the supply chain finance is crucial, which includes to plan on which financial institutions will fund and support, legal documentation, duration for setting up the program and many other aspects.

(Source: Fynance.io)

Advantages of SCF

1. Win- win- win situation

From the perspective of buyers, they are able to extend the payment terms, this will enable the buyer to owns strong cash flow in hand to generate more income and gain strategic advantages in marketplace. On the other side, instead of waiting the buyer to pay off their debt like how it is done traditionally, the suppliers are now able to get the payment earlier from the funder side. Financial intermediary as well could benefit from the chain, where they gain new interest and fee to generate their business.

The win- win- win situation allows good and long lasting relationship between buyer and seller, and hence boost the trading volume in future.

2. Improve business efficiency

Businesses can definitely get more efficient through supply chain financial as it promotes healthy cash flow between the buyer and supplier. The capital can then be fund into new innovation or any economic and industry volatility.

3. Lower supply chain risk

Risk in supply chain is always a great concern for both buyer and supplier, especially dealing with the cashflow. Hence, the supply chain finance able to reduce the risk by ensuring both parties own better cash on hand in any sale transactions.

How does SCF works?

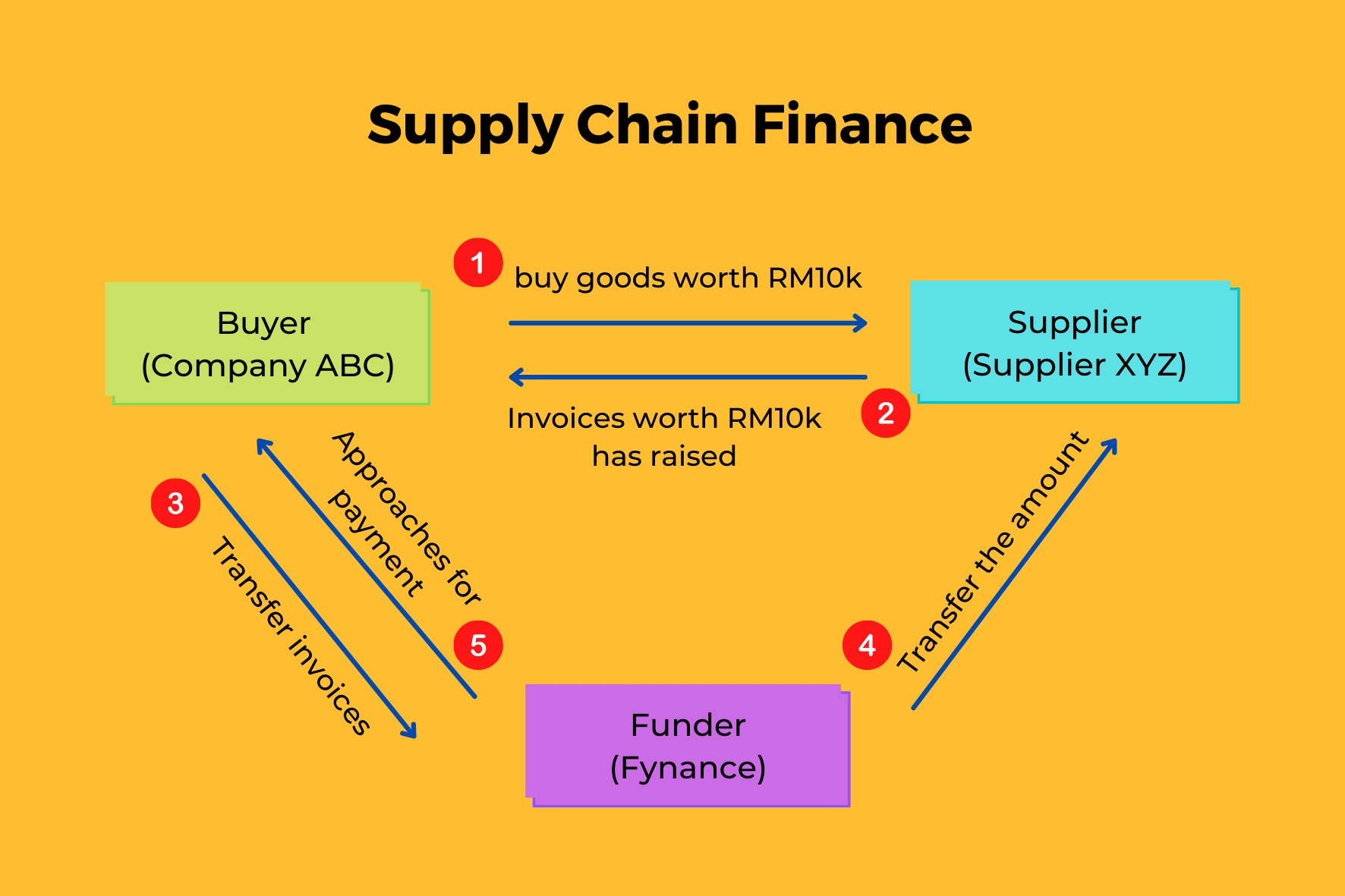

Let's take an example for clearer idea what supply chain finance works in real life situation. Try to imagine a situation where the buyer as Company ABC while the supplier as Supplier XYZ.

(Source: Fynance.io)

- Company ABC (buyer) gets products from Supplier XYZ (supplier) and when it comes to an agreement, the supplier will send invoices to Company ABC.

- The buyer will then approve the invoices and upload to Fynance (Funder).

- The supplier can now access to the Fynance online anytime to see all approved invoices. Supplier XYZ can take advantages of SCF and sells receivables seamlessly to a funder or financial organization through Fynance in order to get early payment. However, if the Supplier XYZ does nothing, fund will reconcile on the standard maturity date.

- For invoices traded before maturity, Supplier XYZ basically gets paid on the next business day with 100% of the invoice, minus a small financing fee.

- At maturity, Company ABC shall pay the full invoice amount to Supplier XYZ or to the respective funder on supply chain finance.

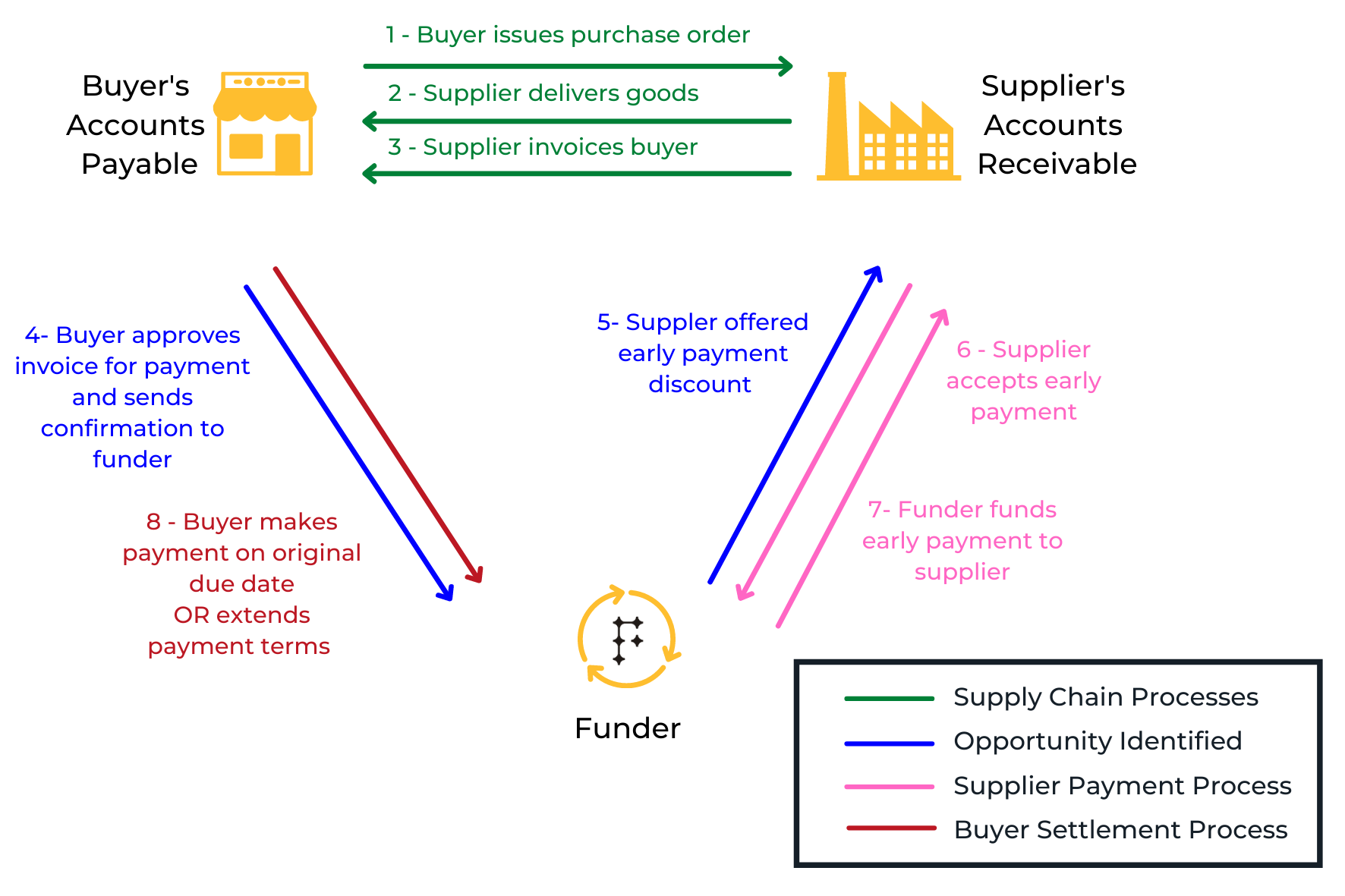

Flow of supply chain finance in sale transaction:

(Source: Fynance.io)

Who benefits from SCF?

Buyer

- Maintain healthy balance sheet and positive cashflow

- Maintain good relationship with suppliers

- Optimize payment terms with supplier

- Able to make purchases in bulk to save costs

- Reduce risk associated with buying goods in bulk

Supplier

- Get payment earlier than usual credit terms

- Reduce financial risk

- Improves financial liquidity and to have more cashflow on hands

- Diversify sources of cash

Financing Source

- New interest and fee generation business

- Increase the potential client's portfolio

Conclusion

Cash flow matters. Moving towards the future, supply chain finance will definitely gain more popularity as it has been seen as the exact solution that optimizes cash flow and at the same time generates long lasting trading and businesses.