"Building Your Path to Financial Success: Tips for Maintaining a Healthy Credit Score" | Fynance

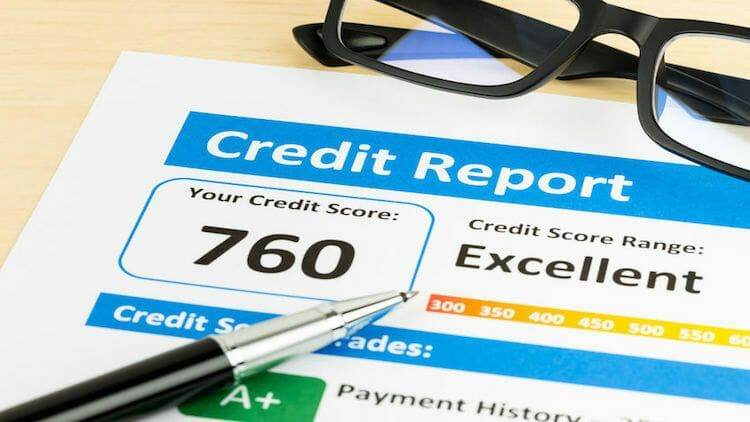

Published byIntroduction: A credit score is a numerical rating used by lenders and financial institutions to evaluate a person's creditworthiness, or how likely they are to pay back a loan or credit card balance on time. Credit scores are based on a person's credit history, which includes factors such as payment history, outstanding debt, length of credit history, types of credit used, and new credit inquiries. Credit scores typically range from 300 to 850, with higher scores indicating a better credit history and lower risk to lenders. A higher credit score can help you qualify for loans and credit cards with more favourable terms, such as lower interest rates and higher credit limits. Conversely, a lower credit score may make it more difficult to obtain credit or result in higher interest rates and fees.

Improving your credit score can be a crucial step in achieving financial stability and obtaining credit when you need it. A good credit score can make it easier to qualify for loans and credit cards with better terms, such as lower interest rates and higher credit limits. While there's no quick fix for improving your credit score, there are 10 suggestions you can take to improve your creditworthiness over time.

1. Pay your bills on time

Paying your bills on time is one of the most important factors that can positively impact your credit score. Payment history is one of the biggest components of your credit score, and missing payments or making late payments can significantly damage your credit score. When you make timely payments on your credit cards, loans, and other bills, it shows that you're responsible with your finances and can manage your debt effectively. This helps to build a positive credit history and can improve your credit score over time. On the other hand, if you miss payments or make late payments, it can have a negative impact on your credit score. Late payments can remain on your credit report for up to seven years, and the longer they go unpaid, the more damage they can do to your credit score. This can make it more difficult to obtain credit in the future, or result in higher interest rates and fees when you do get approved for credit.

2. Keep your credit utilization low

Credit utilization is the amount of credit you're currently using compared to your total available credit limit, and it's calculated by dividing your credit card balances by your credit limits. Lenders and credit reporting agencies use your credit utilization as an indicator of how responsible you are with credit. If you have a high credit utilization rate, it can indicate that you're overextended and may be at risk of defaulting on your debt, which can negatively impact your credit score. By keeping your credit utilization low, ideally at or below 30%, you demonstrate that you're using credit responsibly and not relying too heavily on borrowed funds. This can help improve your credit score over time and make it easier to obtain credit in the future.

3. Pay off outstanding debts

When you pay off outstanding debts, it reduces your overall debt load and improves your credit utilization rate, which can both help to improve your credit score over time. When you have outstanding debts, such as credit card balances or loans, it can negatively impact your credit score by increasing your credit utilization and showing lenders that you may be overextended or at risk of defaulting on your debt. By paying off outstanding debts, you demonstrate that you're taking steps to manage your debt wisely and improve your financial situation. This can help improve your credit score over time and make it easier to obtain credit in the future. Additionally, paying off debts in full can also help to avoid negative marks on your credit report, such as late payments or default notices, which can have a significant impact on your credit score.

4. Don't close unused credit cards

Keeping unused credit cards open can help to increase your available credit, which can lower your credit utilization rate and improve your credit score. When you close an unused credit card, it reduces your total available credit, which can increase your credit utilization rate and negatively impact your credit score. This is especially true if you have balances on other credit cards, as closing an unused card can cause your credit utilization rate to increase significantly.

Additionally, closing an old credit card account can also negatively impact the length of your credit history, which is another important factor that can impact your credit score. The length of your credit history is determined by the age of your credit accounts, and closing an old account can reduce the average age of your credit accounts and lower your credit score.

5. Monitor your credit report regularly

Monitoring your credit report regularly can help to improve your credit score in several ways. First, it allows you to check for errors or inaccuracies on your credit report and take steps to correct them. Errors on your credit report, such as incorrect payment histories or fraudulent accounts, can negatively impact your credit score, so it's important to identify and correct them as soon as possible. Additionally, it can help you identify areas where you can improve your credit score. For example, you may notice that you have a high credit utilization rate or outstanding debts that you can pay off to improve your credit score over time. By monitoring your credit report regularly, you can also detect signs of identity theft or fraud, which can have a significant impact on your credit score if left unchecked. If you notice any suspicious activity on your credit report, you can take steps to protect your credit and prevent further damage to your credit score.

6. Only apply for credit when you need it

If you apply for multiple lines of credit in a short period of time, it can signal to lenders that you're a high-risk borrower who is potentially taking on more debt than you can handle. This can result in a further decrease in your credit score and may make it more difficult to obtain credit in the future. By only applying for credit when you need it, you can minimize the number of hard inquiries on your credit report and avoid signalling to lenders that you're taking on too much debt. This can help to maintain or even improve your credit score over time.

7. Maintain a mix of credit types

When you have a diverse mix of credit accounts, such as credit cards, loans, and a mortgage, it demonstrates to lenders that you're capable of managing different types of credit responsibly. Having a mix of credit types can also help to improve your credit utilization rate and diversify your credit portfolio, which can help to improve your credit score over time. For example, if you have a high credit card balance, having a mortgage or an auto loan can help to balance out your overall debt load and improve your credit utilization rate. When lenders see that you have a track record of responsibly managing different types of credit, they may be more likely to offer you credit with favorable terms and interest rates.

8. Keep credit accounts open for a long time

The method above can help to increase the length of your credit history, which is an important factor that can impact your credit score. The length of your credit history is determined by the age of your credit accounts, and older accounts can have a positive impact on your credit score. When you close a credit account, it reduces the average age of your credit accounts and can negatively impact your credit score. By keeping credit accounts open for a long time, you can maintain a strong credit history and potentially improve your credit score over time.

9. Limit the number of credit cards you have

Having too many credit cards can make it difficult to manage your credit effectively, which can lead to missed payments, high balances, and other issues that can negatively impact your credit score. Additionally, it can also increase your overall credit utilization rate which is the percentage of your available credit that you're currently using. By limiting the number of credit cards you have, you can potentially avoid these issues and improve your credit score over time. However, it's important to note that this doesn't mean you should avoid credit altogether. Having at least one or two credit cards can help you build a strong credit history and improve your credit score, as long as you use them responsibly and avoid accumulating too much debt.

10. Work with a credit counselling agency

One of the key ways that a credit counselling agency can help to improve your credit score is by working with you to develop a personalized debt repayment plan. This plan can help you pay off your debts more quickly and efficiently, which can help to improve your credit utilization rate and demonstrate to lenders that you're capable of managing credit responsibly. Credit counselling agencies can also provide educational resources and tools to help you better understand your credit and debt, and to help you develop healthy financial habits that can improve your credit score over time. Credit counselling agencies can sometimes negotiate with creditors on your behalf to reduce interest rates or set up more manageable repayment plans. This can help you get out of debt more quickly and minimize the impact of negative credit events, such as missed payments or collections.

Improving your credit score can have a number of benefits that can help you achieve your financial goals and improve your overall financial health. Here are some of the key reasons why you should consider improving your credit score:

Access to credit: A good credit score can help you qualify for credit with favourable terms and interest rates. This can include credit cards, loans, and other types of credit that can help you achieve your financial goals, such as buying a home or starting a business.

Lower interest rates: When you have a good credit score, lenders are more likely to offer you lower interest rates on credit products. This can help you save money over the life of the loan and can make it easier to pay off debt more quickly.

Easier approval: A good credit score can also make it easier to get approved for credit, such as a mortgage or a car loan. This can be especially important if you're looking to make a big purchase or invest in a major life event.

Better insurance rates: Your credit score can also impact your insurance rates. Many insurance companies use credit scores as a factor in determining your risk and setting your premiums. A good credit score can help you get lower insurance rates and save money over time.

More negotiating power: When you have a good credit score, you have more negotiating power with lenders. This can help you get better terms and interest rates on loans and credit products, which can save you money and help you achieve your financial goals more quickly.

Overall, improving your credit score can have a significant impact on your financial well-being. By taking steps to improve your credit, you can access better credit products, save money on interest and insurance rates, and achieve your financial goals more quickly and easily.

Keeping your credit score healthy requires ongoing effort and attention to your financial habits. Here are some key steps you can take to keep your credit score in good shape:

Avoid applying for too much credit at once: Each time you apply for credit, it can have a small negative impact on your credit score. If you're planning to apply for a major loan, such as a mortgage or car loan, try to do so within a short period of time so that it counts as a single inquiry.

Use credit wisely: Only use credit when you need to, and make sure you can afford to pay back the debt. Avoid maxing out your credit cards or taking on too much debt at once.

Keep old credit accounts open: Even if you're not using an old credit account, keeping it open can help improve your credit score by increasing the average age of your credit accounts. Just be sure to use the account occasionally so that it doesn't get closed due to inactivity.

Be cautious of co-signing: Co-signing on a loan or credit card for someone else can impact your credit score if you don't make payments on time. Make sure you trust the person and are comfortable taking on that level of financial responsibility before co-signing.

Work with a credit counsellor or financial advisor: If you're struggling with debt or credit issues, consider working with a credit counselling agency or financial advisor who can help you develop a plan to improve your credit and overall financial health.

In conclusion, keeping a healthy credit score is essential for maintaining good financial health. By paying your bills on time, keeping your credit utilization low, monitoring your credit report regularly, and making wise decisions about credit, you can help ensure that your credit score stays in good shape. Additionally, working with a credit counsellor or financial advisor can be a helpful way to get support and guidance as you navigate the complexities of credit and debt. With consistent effort and attention, you can maintain a strong credit score and enjoy the benefits of good credit throughout your financial life.