Cash Management Is The Key To Business Success

Published byA company's lifeblood is cash; it must create enough money from its operations to cover its expenditures while still having enough leftover to repay investors and develop the business. While a company's profits may be manipulated, its cash flow gives insight into improper health. A company that generates enough money may cover its day-to-day demands while avoiding debt. This provides the company with more control over its operations.

When a company is forced to borrow money to cover its expenditures, its creditors are likely to have a role in its operations. If they hold opposing views to management, it may be difficult for management to carry out its vision for the business. A business will struggle to execute everyday tasks such as paying suppliers, purchasing raw materials, and paying staff if it does not generate enough revenue to fulfil its needs, much alone make investments. It must also have enough cash to pay dividends and keep its investors pleased. Some corporations may utilize their capital to reward shareholders through share repurchases.

Image @Innovia Partners

·

Even if a business generates a profit by generating more income than what it spends on costs, it must manage its cash flow properly to be profitable. An organization's cash flow is linked to its operations or commercial activities, investment activities (such as the acquisition or sale of capital equipment), and finance activities (such as raising debt or equity funding or repaying such funding). The cash generated by a company's operations is linked to its primary business activities and offers the finest opportunity for cash flow management.

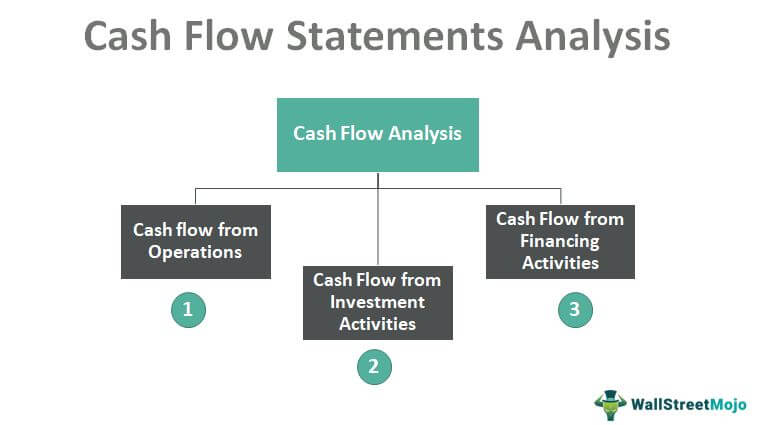

Cash flow measures how much money a company brought in or spent more than a given time horizon. On the statement of cash flows, a joint financial statement, cash flow is often split down into cash flow from operating operations, investing activities, and financing activities. If your net cash flow number is positive, your company is cash flow positive, and saving money ends the month with less cash than you began with. Positively or negatively, cash flow is possible. A corporation with positive cash flow has more money flowing into it than out of it. A negative cash flow shows that a company's money flows out rather than in.

Profit and cash flow are both important elements of a healthy, growing business, but they are not the same thing.——By Ken Boyd

Revenue less costs equal profit. Net profit is another term for it. The inflows and outflows of cash for a particular firm are called cash flow. Positive cash flow suggests that more money flows in at any specific time, whereas negative cash flow means more money is leaving.

Money flowing in and out of your business is called cash flow. Profit is your net income after deducting expenditures from sales. A company might be lucrative yet still not have enough cash flow.

Image @Inc. Magazine

·

A company might have a lot of cash yet not earn a profit. Many firms struggle with either cash flow or earnings in the short term. Rapid or unanticipated growth might result in a cash flow and profit problem. Cash flow and profit are required to continue business in the long run. Analysts look at three forms of profit: gross profit, operational profit, and net profit. Each gain provides the analyst with additional information about the company's performance, particularly compared to previous periods and industry competitors. The income statement shows all three degrees of profitability.

·

The primary distinction between cash flow and profit is that. In contrast, profit represents the amount of money left over after all costs have been met, and cash flow represents the net movement of cash into and out of an organization. Investors and business owners frequently look for a single statistic to determine a company's health. They want a single line item on a financial statement to assess if they should invest or change their company plan. In these cases, cash flow and profit are frequently set against one another. But which is more significant?

/cash-flow-how-it-works-to-keep-your-business-afloat-398180-v3-5b734281c9e77c0057b67a4c.png)

Image @The Balance Small Business

·

For example, a corporation might succeed with a negative cash flow, limiting its capacity to pay bills, develop, and grow. Similarly, a company with positive cash flow and expanding sales might fail to turn a profit, as many startups and scaling enterprises do. Profit and cash flow are only two of the hundreds of financial words, measures, and ratios you should be familiar with to make sound business decisions. It is possible to progress professionally and become a more knowledgeable investor or company owner by obtaining a deep understanding of critical financial principles.

Image @Unplash

·

Cash flow has four essential guidelines to remember while creating your cash flow statement:

- 1st, transactions which enhance property result in a loss in cash flow.

- 2nd, deals that result in a drop in assets result in an increase in cash flow.

- 3rd, operations that raise liabilities result in an increase in cash flow.

- 4th, actions that result in the decrease in liabilities result in a drop in cash flow.

Image @Invoicera

·

Is cash flow important?

This is because the inflow and outflow of money from a firm are referred to as cash flow. It is required for everyday operations, taxes, inventory purchases, staff compensation, and operational expenditures. Positive cash flow shows an increase in a company's liquid assets. This allows it to pay off debts, reinvest in the firm, return money to shareholders, pay expenditures, and build a cushion against future financial difficulties. Negative cash flow shows a decrease in a company's liquid assets.

·

Image @ Wall Street Mojo

·

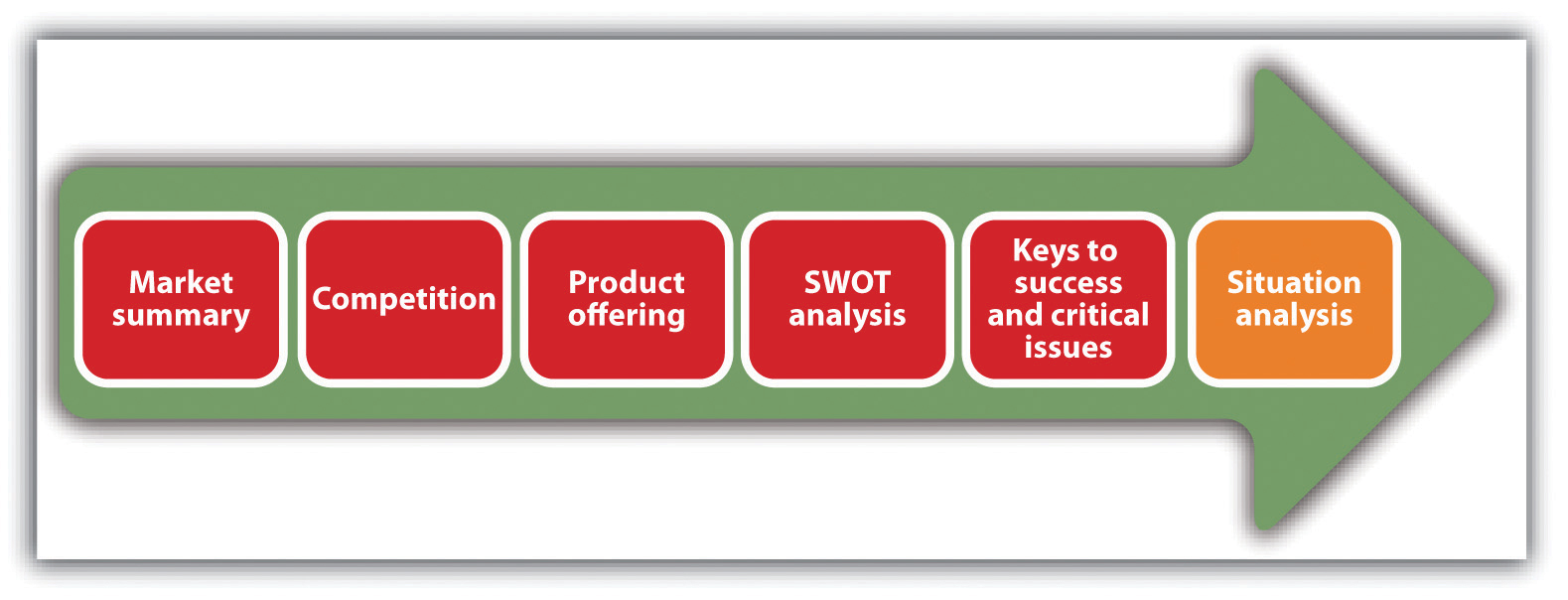

How to manage cash flow? Here have some recommended practices for reference by other online platforms sharing for managing a healthy cash flow. As:

- Recognize problems at an early stage on. However, the earlier you identify an issue, the better, and the easier it may be to resolve it. For one example, if you have to call your bank to seek any leniency or suppleness, they'll be much more inclined to assist you if you ask them ahead of time.

- Know the fundamentals of accounting. You'll be able to comprehend and comprehend financial statements if you grasp the fundamental ideas of basic business accounting, and you will be better equipped to manage your company's financial health and maintain cash flow positive if you understand the essential principles of basic business accounting.

- Keep a tight eye on your financial flow. Pay special attention to all of the metrics listed in "Metrics to Measure" on a regular basis. All of these metrics should be accessible to you and/or your chief financial officer promptly and simply.

- Make frequent predictions. You'll be able to generate better, more accurate, and up-to-date estimates of future cash flow if you regularly monitor critical cash flow data or variables, and you'll be more likely to keep your organization out of financial difficulties.

- Invoice promptly. Any delays in billing your clients will just lengthen your wait for money for your job. Small enterprises should bill clients as soon as the service is finished.

- Make judicious and effective use of technologies. There are tools available to help you manage your cash flow effortlessly and successfully. These include small business software such as Paypal as well as cloud (Digitally) accounting services.

Image@ FlexJobs

·

Cash flow is vital because it allows you to satisfy current financial responsibilities while also planning for the future. Based on your general costs and past revenue data, cash flow projections anticipate your future incomings and outgoings. You may use a cash flow projection to determine if you will have a cash shortage or surplus in the future and utilize this information to make decisions.

For example, if you anticipate a shortage, you can explore cost-cutting, and if you expect a surplus, you might consider expanding into new areas. Nicholson adds, advises anticipating at least three months in advance:

"Cash flow forecasting allows you to prepare for larger purchases, investment, and strategic plans for future growth."

Image @ Freepik

·

Receivables management, investment and financing, personnel management, market environment, payment management, and working capital acquisition are six critical factors that affect cash flow.

Receivables are the funds owing to a corporation after providing goods and services. Outstanding receivables are accounts receivable that have not been paid in full by the client or customer. Small company owners face cash flow issues not because they don't have enough funds in the pipeline but because they lack sufficient money to cover current needs. According to surveys, small company owners in the US have access to an average of $20,000 in outstanding receivables. This makes it critical that you handle your receivables properly to minimize cash flow concerns.

The industry's investment and finance strategies will also impact its working capital. The current operations are used to make investment choices. If your firm buys real estate or expensive equipment such as machinery, this might significantly reduce your cash flow. Similarly, your company's financial decisions over how to fund these purchases will influence your cash flow.

Image @ Freshbooks

·

Cash flow issues affect not just minor business owners and also company staff. Because of a lack of operating cash, company owners struggle to pay their employees on time. Around 43% of small firms experiencing cash flow issues are in danger of missed wage payments. Unfortunately, 32% of small company owners have overpaid their personnel. Late payments might hurt your employees' life. Some folks live paycheck to paycheck to make ends meet. When business owners fail to pay their employees on time, they will most likely look for new employment to escape the suffering this causes them.

Image @ Github Pages

·

After that, the market situation also impacts small companies working capital. You are mistaken if you believe market activity does not affect small firms. The present status of the market influences small companies investing and financing. If larger organizations have difficulty getting loans, tiny businesses with few debt alternatives generally have fewer possibilities. Smaller companies should be more careful when it comes to financial holdings. They must be able to see an ROI within a specific time frame.

Image @ Freshbooks

·Payment administration is another factor influencing cash flow for small business owners managing payments. 53% of firms send out invoices to be paid on a specified date, generally after the services are performed. In contrast, 47% request upfront payment. Depending on the deal, customers can pay company owners before, during, or after receiving their products or services. However, payment processing takes time for small enterprises. 31% of small firms indicated they must wait more than a month to process payments. Furthermore, 66% of small business owners believe that payment processing is one of the causes of cash flow issues.

Image @ Mortgage Professional

·

Small enterprises require working capital. You won't be able to support everyday business operations if you don't have adequate cash. And owners who have little working capital frequently look for rapid business loans to obtain financial assistance. However, over 39% of small company owners reject to seek business loans for three primary reasons:

- high interest rates

- monthly payments

- won't qualify

·

Lastly, cash is a vital indication of a company's financial health; its management and visibility are essential. During the epidemic, "financial excellence" was critical in allowing early-stage businesses to maintain operations. Cash excellence becomes a crucial lever for freeing resources to invest in growth as a firm grows.