Stop Using Your Own Money to Fund Your Business! Top 9 Methods to Finance Your Business in Malaysia

Published byBusiness owners face the dilemma of whether to risk their personal savings or even assets to fund their business expansion constantly. Most are unsure of the most efficient and effective ways to finance their businesses.

Undoubtedly, running a business is challenging. Every single step and decision leads to massive impacts or even ripples. Therefore, planning is the key. Prior to any business finance solutions, it is necessary to go through a complete Business Financial Analysis and Business Valuation. This helps business owners understand their business’s financial position. It is strongly recommended to seek professional opinions and research to avoid making a wrong move.

Let’s take a look at the 9 methods to finance your business at this Pandemic Period!

01. Crowdfunding

Crowdfunding, as the name suggests, is the act of gathering a small amount of capital from a large number of individuals. This is the best method for startup business owners to finance their business venture. In the earlier days, entrepreneurs could only rely on bank loans, angel funds, risk investors or loans from friends and family.

The sum of crowdfunding typically comes from the investors’ personal assets. When investors participate in crowdfunding, it’s comparative to investing in the stock market. Crowdfunding allows entrepreneurs and charity associations to finance their organizations through expanding investors pool beyond their existing circle.

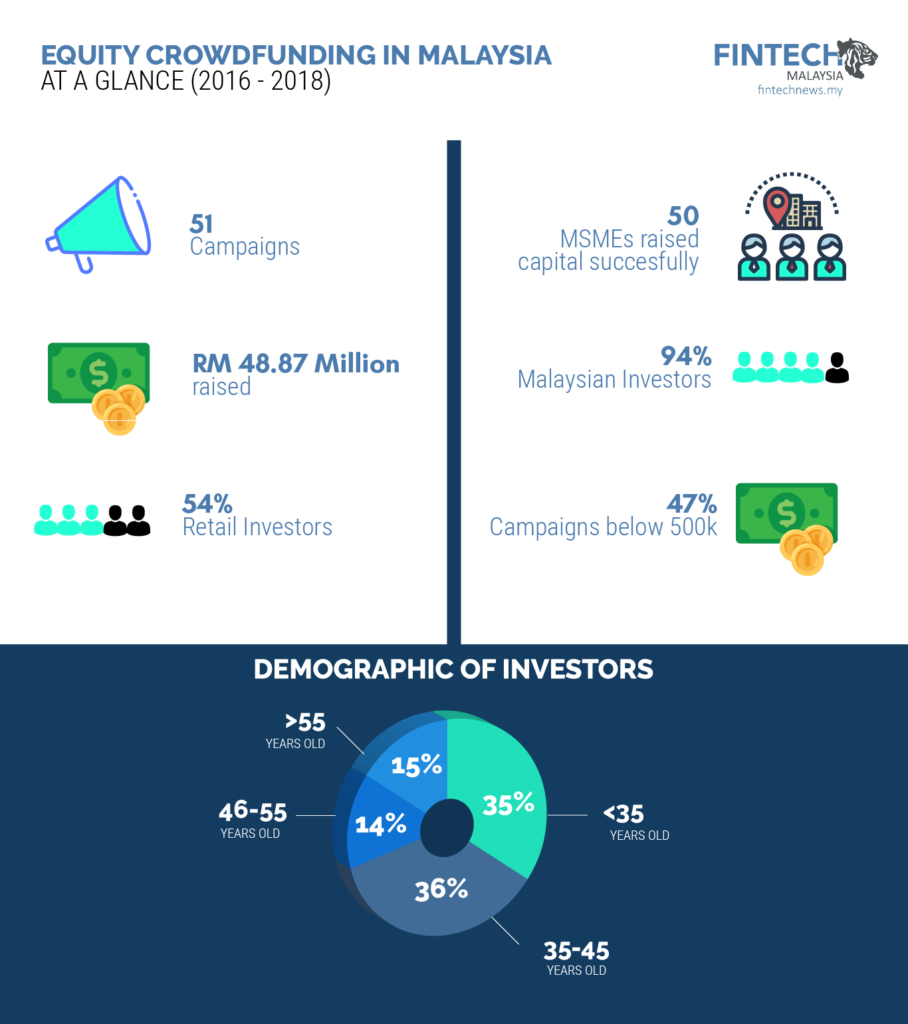

The Malaysian government has been supportive in this area, thereforth we are the first country amongst ASEAN countries to have complete law and regulations for crowdfunding. Specifically, Equity Crowdfunding in Malaysia is regulated by the Securities Commission (SC). Mushrooming of crowdfunding platforms such as Ata Plus, Crowdo, MyStartr and ALIXCO has been observed.

image@fintech Malaysia

02. Angel Investor

Angel Investors are also known as private investors, seed investors or angel funders. They are usually high networth individuals who provide financial backing for small startups or entrepreneurs, in exchange for ownership or equity in the establishment.

Angel investors in the market have come together to form an organization, and the organization is rapidly increasing its network. They come together to share information as well as to pool their funds for certain projects. While they have given you the financial backing, it’s expected of you to share with them your company financial report.

In this digital era, angel investors are mostly anonymous. By leveraging the right platforms, business owners may arrange meetings to present their business ideas and plans to attract angel investors. List below are some of digital platforms you may reach out to angel investors:

Angel Investment Network

Capital

BizAngel

Cradle Fund

03. Invoice Financing

Invoice financing is commonly utilized by SMEs providing credit to their customers. It helps businesses ease their cash flow, pay employees and suppliers, and reinvest in operations and growth. Invoice financing can be executed without affecting the businesses’ clients.

While shortage of funding and cash flow is a common difficulty among SMEs, invoice financing is a well-suited short term solution that doesn’t affect SMEs’ financial record with commercial banks. It is essentially an act where business owners use their unpaid invoices as collateral for financing.

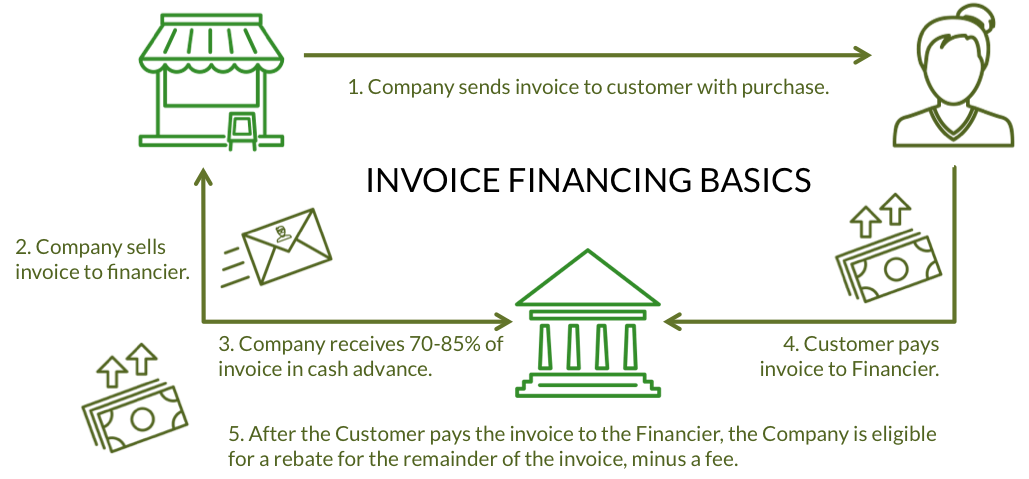

How does invoice financing work?

An invoice is issued to customers upon completion of service or products being sent. Customers are expected to pay off the invoice amount within an agreed credit period, usually 30 days, 60 days, 90 days or even 120 days.

The financial institution providing invoice financing facility will release a fund amounting to 70% to 100% of the invoice value. When the invoice is due for payment, the customer will pay 100% to the financial institution. Following that, the financial institution will remit the remaining amount to business, after accounting in cost of fund and charges.

Image@thenewsavvy

04. Government Funds & Grants

Government funds and grants are one of the preferred ways to finance a business. The Malaysian Government is more supportive of startup business and business innovation than many other countries in the world. There are existing regulations that are very encouraging, including omitting the need of guarantor or collateral and zero processing fee. These government funds and grants are definitely worth the tedious process that comes with it. Entrepreneurs may check out the listed funds and grants below:

TEKUN Financing

MDEC Development Fund

Business Accelerator Programme 2.0 (BAP 2.0)

Pernas Medium Enterprise Development Franchise Scheme

Crade Investment Programme 300 (CIP 300)

05. Unsecured Loan

When applying for an unsecured loan, SMEs owners do not need to provide any collateral. Hence, an unsecured loan is also known as a clean loan. It implies greater risk to financiers, as well as the businesses. Consequently, the interest rate and applying criteria is usually higher too.

Compared to other SME financing facilities, the facility amount is smaller and relies heavily on the applying companies’ credit profile and business model. Credit profile refers to the companies’ existing repayment record, commonly known as CTOS score and CCRIS records. Applying companies with high credibility will usually be offered a facility with lower interest rate, in accordance to a lower default rate. Unsecured loan is approved with a monthly repayment plan, that is usually between 3 to 5 years.

Unsecured loan is the best solution for SMEs that have no assets. Most commercial banks in Malaysia offers unsecured business loan, including:

Maybank

Public Bank

CIMB Bank

Ambank

OCBC Bank

Hong Leong Bank

RHB Bank

Bank Islam

HSBC Bank

06. Secured Loan

As the name suggests, secured loan requires collateral, specifically property or land pledging. Collateral serves as a “guarantee” for payment of a loan. In the event of defaulting loan, the financier may overtake or foreclose the collateral to pay the outstanding balance.

While the risk of losing principal has been lowered, the financier can now offer a lower interest rate for secured loans. On top of that, the application criteria is generally less stringent as compared to an unsecured loan. The loan amount is determined in accordance with the valuation of said collateral, as well as the loan-to-value ratios in accordance with the financiers’ policies.

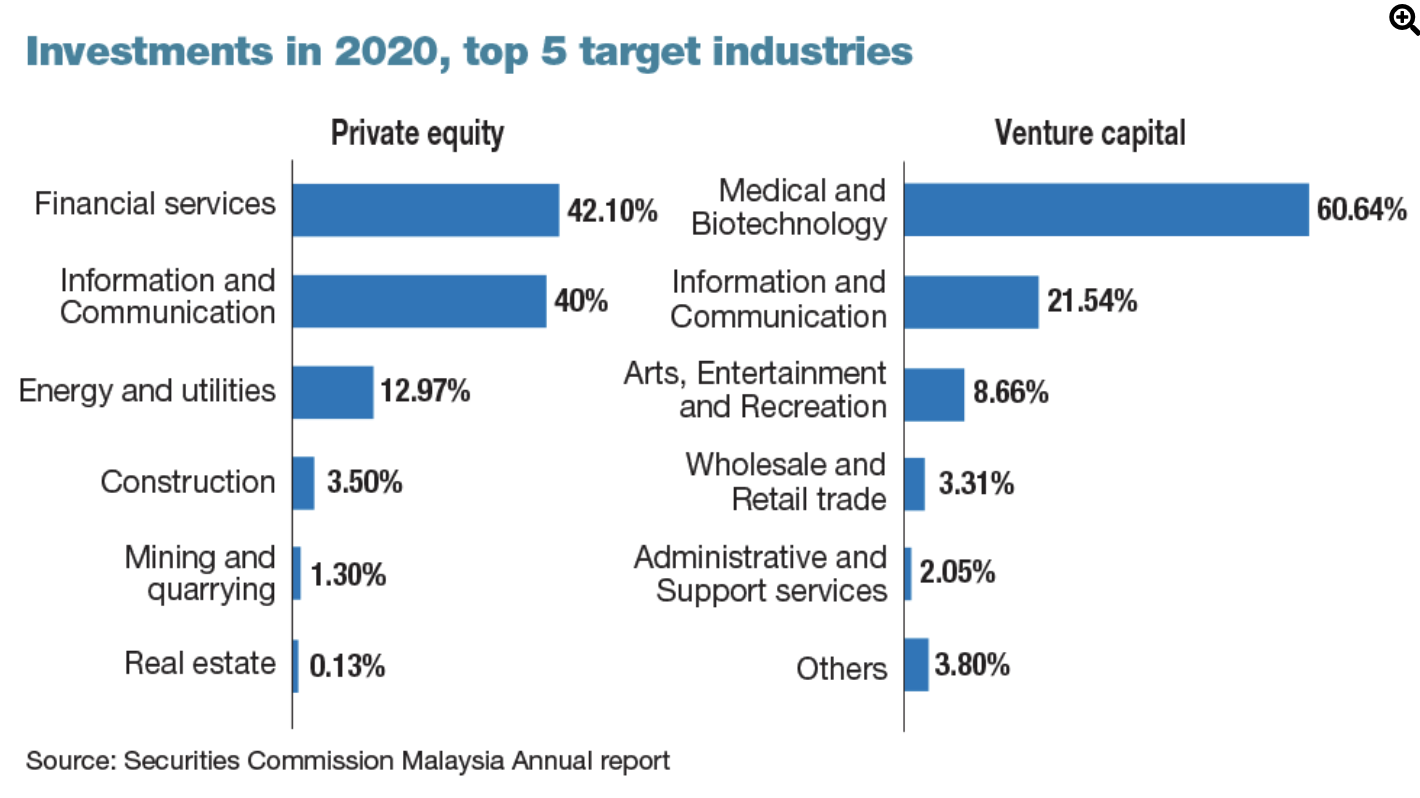

07. Venture Capital

Venture Capital, also known as risk investment, is a form of private equity, where investors provide financing to businesses with potential. It is done either through direct purchase of equity or providing funding to the business.

Venture Capital exists to maximize profit in invested companies. On top of funding, venture capital instills professional knowledge and advice. Funding provided by venture capital helps new ventures or unlisted companies in pursuit of long-term profits and lasting business models. The partnership is expected to be a win-win situation.

Undoubtedly, investors from venture capital are looking for profit growth. To achieve that, venture capital companies will be there to consult on financing activities while monitoring business growth.

NEXEA

RHL Ventures

TBV Capital

500 Start-ups

Vertex Ventures

Image@ The Edge Markets & Securities Commission Malaysia Annual report

08. Bridging Loan

Bridging Loan, a.k.a. Bridge Financing, is a temporary financing with the purpose to cover a project’s short term costs, until regular long-term financing is being secured. It is mainly used by SMEs such as main contractors of certain property developments.

Owing to the common practice among the real estate development market, bridging loan is required to solve temporary needs of capital to initiate a project. Bridging loans are usually with shorter repayment periods, such as six months to a year.

09. Working Capital Financing

Working Capital Financing is a SME bank facility taken to increase cash flow for day-to-day operations, including material cost, payroll and other purposes, rather than to purchase additional equipment or for investment. In short, it is utilized for business expansion.

It is one of the most commonly used financing solutions as it helps overcome the challenges of unstable cash flow. Subsequently, it aids business growth. All businesses require working capital.

We observe the average age of entrepreneurs is getting younger. Traditional business financing solutions may seem less viable, especially secured loans if the entrepreneurs do not possess properties. Additionally, we understand different financial institutions have different policies, hence different application criteria, such as business nature, business model and vintage.

SME owners can seek professional advice and consultation from professional firms such as Vanta Capital, a one-stop business financing solution firm. At Vanta Capital, we provide one-to-one professional business finance consultation, various financial aids for different stages of business growth. With over 11 years of expertise in business loans, we ensure a company’s smooth sailing in acquiring business financing, subsequently, successful business growth.